- Home

- Services

- Meet the Team

- Help & Advice

- Useful information

- Companies

- Expenses for directors

- Travel

- Car Benefit

- Buying or Leasing

- Closing a Trading Company

- Capital Distributions on Winding Up

- Non-Trade Income

- Cash Surplus on Balance Sheet and Effect on Trading Status

- Trading Company – Definition

- Company Losses

- Share Structure

- Selling Assets to the New Company

- Super-Deduction

- Payroll

- Penalties

- The Contract Employment Status Tool (CEST)

- The Employment Status Indicator (ESI)

- Benefit in Kind

- Construction Industry Scheme (CIS)

- VAT

- Deadlines

- Penalties

- Deductible Expenditure

- Disallowable Expenditure

- What is Making Tax Digital (MTD)?

- Place of Supply: Goods

- Accounts

- Cash Basis

- Accruals Basis

- Expenses you can claim Entertaining And Gifts To Employees\Directors

- Entertaining

- Gifts Over £50 to Staff

- Gifts to Customers and Suppliers

- Free Food and Drink

- Staff Meetings and Training

- Motor Expenses

- Interest on Car Loans

- Mileage

- Actual Costs – Running Expenses

- Buying or Leasing

- Ownership

- Vans

- Travel

- Accommodation

- Subsistence (Food and Drink)

- What Can I Claim For “Use Of Home”

- Gifts And Donations

- Rental & Holiday Lettings

- Trading And Property Allowances

- What is a Furnished Holiday Letting (FHL)?

- Property Ownership

- Unmarried Owners

- Married Couples and Civil Partners – Joint Ownership

- Partnership

- Keeping Records

- Expenses

- Capital Outgoings and Recent Changes

- Capital Gains

- Repairs/Capital improvements

- Capital Gain

- Pay Capital Gains Tax in 30 Days

- Here are Some Terms you should be Aware of

- Entrepreneurs’ Relief (ER)

- Separation

- Contact

Help & Advice

Useful information

Self-Assessment Tax Return

Record keeping

These must be kept until the end of the fifth anniversary of 31 January next following the tax year. Effectively 2 months short of 6 years.

The type of records required will depend on your personal circumstances but will generally include:

- Bank or Building Society statements

- Details of any State Benefits received

- Dividend vouchers

- Forms P60 and P11D

- Details of any acquisition and disposals of capital assets

For those in business or letting property you must keep detailed records in respect of the activities of the business and rental. This includes full bookkeeping records with supporting documentation (receipts, invoices, contracts business mileage records).

Where there is insufficient support for the HMRC can refuse to give relief for expenses and can impose penalties (up to £3,000 per year).

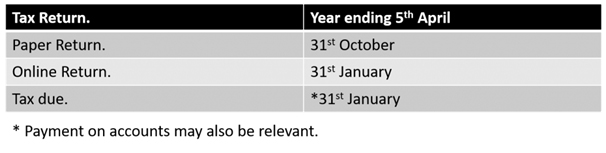

Deadlines And Penalties - Self-assessment

You will be charged £100 for missing the initial deadline, Further penalties will be applied if your tax return is more than 6 months late.

You will also be charged interest and penalties for late payment.

https://www.gov.uk/estimate-self-assessment-penalties

You can appeal against penalties providing you have a reasonable excuse.

Tax Rates& Thresholds

Higher rate taxpayers

Gift Aid – If the donation is made by an individual tax relief is available at the taxpayer’s highest rate. The individual pays the net amount to the charity and claims the higher rate relief on their tax return. The charity claims the basic rate deduction. If the individual does not have a tax liability to cover the amount claimed by the charity this will be clawed back by HMRC from the individual.

Withdrawal of Child Benefit – If you or your partner claim Child Benefit and your income is between £50,000 and £60,000 some/all of the benefit is clawed back.

Withdrawal of Personal Allowances. For every £2 you earn over £100,000 your personal Allowance is reduced by £1.If you anticipate this happening in future years you may wish to consider rearranging your tax affairs by:

- reducing or delaying income,

- bringing forward income (so you avoid this the following year),

- diverting income to your wife or,

- making some form of tax-deductible investment i.e. a personal pension contribution.

Personal Pensions

Personal Pensions can be extremely tax efficient especially if you are paying higher rate tax and approaching 55.Tax relief is usually available on contributions.Funds in your pension pot grow tax free and can be outside your estate for inheritance tax (IHT) purposes.You can contribute up to your “relevant earnings”. If you have no “relevant earnings” then up to £3,600. There are also annual and lifetime contribution limits. If these limits are exceeded there will be a tax charge. The annual limit (called the Annual Allowance) for 2022/23 is £40,000. This can be tapered down to £4,000 where your “adjusted income” is over £240,000.Employers can also contribute and again there are annual and lifetime limits. The contributions do not count as a benefit in kind for the employee and there is no NIC charge. There is now a Pension Advice Allowance. An employer can pay for up to £500 of retirement financial advice for an employee tax free.You can have a personal pension over which you have personal control. This will allow you to alter your contributions, suspend them, or stop them completely.On reaching 55 you can choose how much to withdraw (without limit) from your defined contribution (DC), or ‘money purchase’ pension savings. You have a range of options when you decide to take benefits such as purchasing an annuity or electing for capped or flexible drawdown. You do not have to buy an annuity.Up to 25% of the pension can be taken tax free. The remainder is taxed at your highest rate.The lifetime pension saving allowance for 2022/23 is £1,073,100.A good strategy is to make contributions while you are paying higher rate tax and then draw down when you retire and are perhaps only liable to basic rate tax. Pensions are long-term investments. You may get back less than you put in. They are also subject to tax and regulatory change.

We only deal with the tax aspects. If you wish to look at this in greater detail, you should contact your pension adviser.

https://www.moneyhelper.org.uk/en/pensions-and-retirement/pension-wise?source=pw

• Pensions and tax – The Pensions Advisory Service.

Marriage Allowance

If you are married or in a civil partnership and have insufficient income to fully use your personal allowance, then you can elect to transfer 10% of your allowance to your partner if they are a basic rate taxpayer. A claim can now be made on behalf of a deceased person and back dated 4 year

https://www.gov.uk/apply-marriage-allowance