- Home

- Services

- Meet the Team

- Help & Advice

- Useful information

- Companies

- Expenses for directors

- Travel

- Car Benefit

- Buying or Leasing

- Closing a Trading Company

- Capital Distributions on Winding Up

- Non-Trade Income

- Cash Surplus on Balance Sheet and Effect on Trading Status

- Trading Company – Definition

- Company Losses

- Share Structure

- Selling Assets to the New Company

- Super-Deduction

- Payroll

- Penalties

- The Contract Employment Status Tool (CEST)

- The Employment Status Indicator (ESI)

- Benefit in Kind

- Construction Industry Scheme (CIS)

- VAT

- Deadlines

- Penalties

- Deductible Expenditure

- Disallowable Expenditure

- What is Making Tax Digital (MTD)?

- Place of Supply: Goods

- Accounts

- Cash Basis

- Accruals Basis

- Expenses you can claim Entertaining And Gifts To Employees\Directors

- Entertaining

- Gifts Over £50 to Staff

- Gifts to Customers and Suppliers

- Free Food and Drink

- Staff Meetings and Training

- Motor Expenses

- Interest on Car Loans

- Mileage

- Actual Costs – Running Expenses

- Buying or Leasing

- Ownership

- Vans

- Travel

- Accommodation

- Subsistence (Food and Drink)

- What Can I Claim For “Use Of Home”

- Gifts And Donations

- Rental & Holiday Lettings

- Trading And Property Allowances

- What is a Furnished Holiday Letting (FHL)?

- Property Ownership

- Unmarried Owners

- Married Couples and Civil Partners – Joint Ownership

- Partnership

- Keeping Records

- Expenses

- Capital Outgoings and Recent Changes

- Capital Gains

- Repairs/Capital improvements

- Capital Gain

- Pay Capital Gains Tax in 30 Days

- Here are Some Terms you should be Aware of

- Entrepreneurs’ Relief (ER)

- Separation

- Contact

Help & Advice

Companies

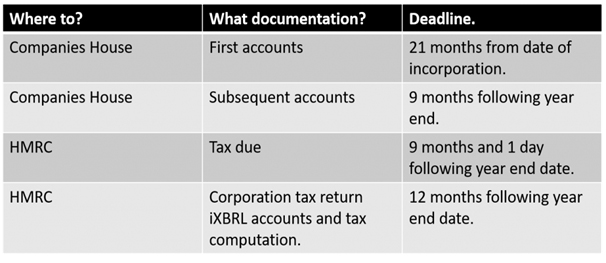

Deadlines

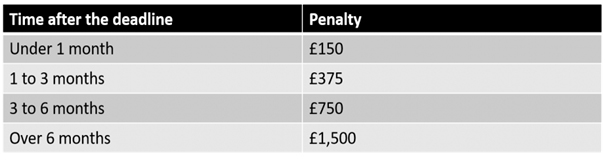

Penalties Companies House

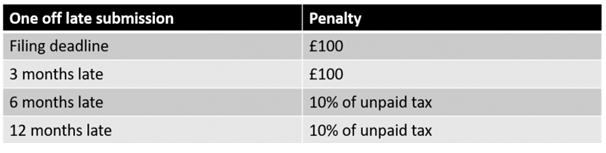

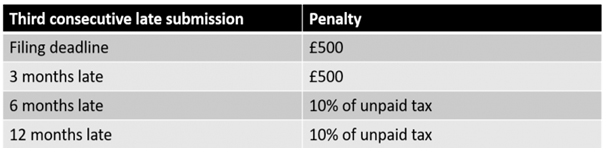

HMRC

Tax Rates

If you use a company, the profits will be liable to Corporation Tax at 19% (marginal rates will apply from 1 April 2023). Companies with profits of £50,000 or less so that they will continue to pay Corporation Tax at 19%. Companies with profits between £50,000 and £250,000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax rate.

https://www.gov.uk/government/publications/corporation-tax-charge-and-rates-from-1-april-2022-and-small-profits-rate-and-marginal-relief-from-1-april-2023/corporation-tax-charge-and-rates-from-1-april-2022-and-small-profits-rate-and-marginal-relief-from-1-april-2023

Taking money from your company

For shareholders and directors of limited companies the main ways of taking funds from the company are:

- Dividends

- Tax efficient benefits.

- Loans to directors.

- Salary

Dividends

Owners of smaller private companies are usually the shareholders and directors. They can then choose how to withdraw funds. Currently dividends are the most tax efficient method.

For 2022/23 the first £2,000 is tax-free. The rates are then:

- 8.75% if part of the basic rate income tax band.

- 33.75% if part of the higher rate income tax band, and

- 39.3 % on the excess.

Tax efficient benefits

Consider:

- Employer pensions.

- Employer supplied pensions advice.

- Workplace nurseries.

- Cycle to work schemes

- The provision of an ultra-low emission vehicle emitting 75g CO2/km or less.

- Meals in a staff canteen.

- Hot drinks and water at work.

- A mobile phone.

- Workplace parking.

- Christmas parties up to £150 per head.

Financial benefit awards from an employer. Where employees come up with ideas that can make the employer money. The amount that can be claimed is the greater of 50% of the financial benefit in the first year, or 10% of the financial benefit in the first five years. In both cases this is subject to an over-riding cap of £5,000.

- In-house sports facilities.

- Counselling for redundant staff.

- Use of works buses.

- Equipment and facilities for employees to help with their job.

- A long service awards.

- A trivial benefits exemption of up to £50 per benefit. This cannot be cash or a cash voucher. Limited to £300 for directors and connected persons.

Salary

For directors with no other income and if there is more than one employee and the Employer’s Allowance is available then a salary equal to the Personal Allowance (£12,570 for 2022/23) will be more tax efficient.

Directors’ overdrawn current or loan accounts

If a director borrows money from their company but they must comply with the 2006 Companies Act. A shareholder approval (by ordinary resolution, subject also to the provisions in the articles) is required for loans in excess of £10,000 (£50,000 if the loan is to meet expenditure on company business). Also, the company should agree loan terms and have supporting documents.

Where there is an overdrawn director’s account there is potentially a S455 charge on the company and a taxable benefit on the director in respect interest-free loan.

S455 CTA 2010 – company tax charge

If a director (or any other participator in a close company) leaves a loan account outstanding for more than 9 months after the company’s accounting period end, the company will be required to pay tax under s.455 CTA 2010. This is payable at 32.5% of the outstanding loan balance and becomes due 9 months after the end of the accounting period. When the loan is repaid in full or in part s.455 tax is wholly or partly repayable 9 months after the end of the accounting period in which the repayment is made. The Revenue’s online form to reclaim

Taxable benefit on the director

If the overdraft on a director’s account with the company exceeds £10,000 it is treated as a loan. A taxable benefit will arise on the loan when the employee does not pay interest to the employer at HMRC’s official rate of interest. The cash benefit is the difference between interest calculated at HMRC’s official rate and the interest paid. The taxable benefit of interest calculated is required to be reported on form P11D. This will also be liable to Class 1A NICs

https://www.gov.uk/government/publications/rates-and-allowances-beneficial-loan-arrangements-hmrc-official-rates

Write off an overdrawn director’s loan

When a company writes off a loan made to a director the amount is treated as a dividend and as earnings for NICs purposes. In addition, it is an unallowable expense for Corporation Tax purposes.

Consider declaring a dividend to clear the loan as this will avoid the NICs charges.

Drawings For Directors

Beware directors who continue to draw down more money than their salaries or dividends allow.

The real sting is not so immediately obvious, but it will affect those directors who continue to draw down more money from their company each month than the RTI-reported salary, expenses and available declared dividends provide for. Continuing to do this against good tax planning advice is just going to precipitate a higher tax bill when the year-end accounts are prepared.

The company will face a 32.5% surcharge to Corporation Tax for any loans made to a director in the year if the amount has not been fully repaid within nine months of the tax reporting date. The extra tax paid can be reclaimed back from the HMRC when the director’s loan has been repaid, but as it can take over a year to receive the refund, such surcharges can often be a disaster as far as business cash flow is concerned.

The need to consider the tax implications of a director’s loan often only materialises when the year-end accounts are prepared, and it is discovered there is insufficient distributable profits to cover the withdrawals made. To make matters worse, we often find the company cannot afford to pay the extra tax on an overdrawn director’s loan account, nor can they afford to pass the required bonus as a salary after the event and before the expiry of the nine months’ limit to clear it. The only other remaining option available is the director to repay the overdrawn amount back to the company from private funds.

The new and worrying dimension to the director’s loan question will arise where a director has created the loan by regularly making a series of withdrawals each month from the company’s bank account for private expenditure that cannot be supported by the salary and legitimate dividends declared. The Companies Act now allows companies to vote through a loan to a director and a properly convened meeting that is duly minuted and recorded in the company’s records. That is not the same as a situation where the director just uses the company’s bank account as an extension of his own private bank.

HMRC will want to charge tax and NI on private payments.

The issue here is that the HMRC will be fully justified in viewing these private payments as distributions subject to PAYE/NI. There is nothing new in that treatment, but the profession is waiting to see how the HMRC will apply the penalties to what will be false accounting by the employer under the RTI rules if there are grounds the employer should have realised that the salary and dividends, they were presumably voting through were insufficient to cover the actual withdrawals being made.

The point we hope directors of small companies take on board is they can no longer declare monthly dividends on a wing and a prayer to cover the money they withdraw from the company each month. Every dividend declared must be covered by a signed minute approving the dividend with due regard to making sure the company has the distributable reserves to support it. If companies and directors do not take enough care over how they extract their profits from their company, then RTI may just come back and give them one hell of a headache over the next few years.